Single Family Residential Statistics

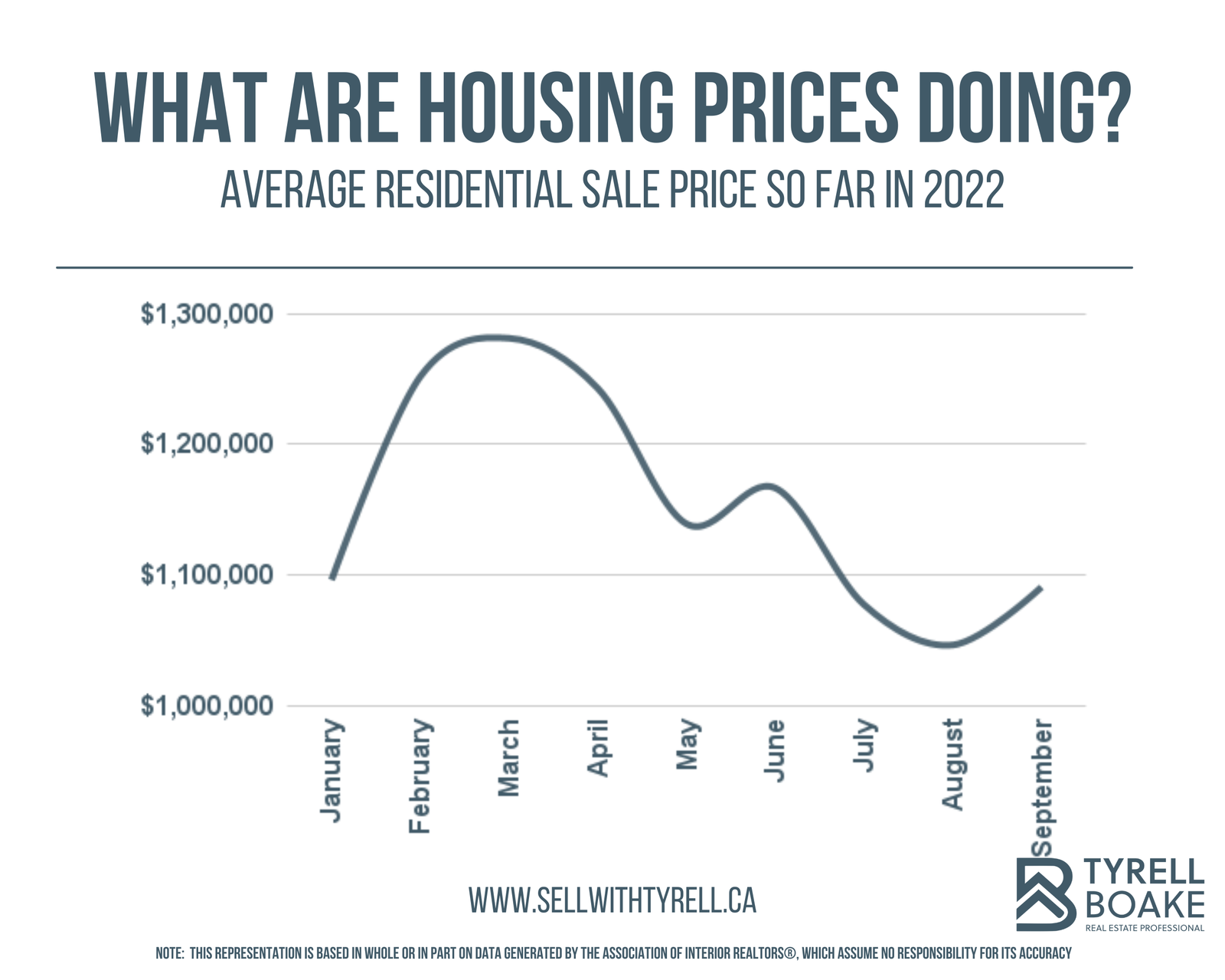

The Average Sale Price shows the YTD price of all sales in 2022, and it has continued to decline since the market peaked in March of this year. The average sale price in September was $1,090,830 for a single family residential property, up slightly from $1,046,552 in August 2022. Prices seem to be adjusting but not at the rapid pace we saw earlier in the late spring. So, the Year to Date overall average price is still declining but the month to month price is up slightly.

Are we seeing the bottom of the decline? It's probably too early to tell, and the only time we really can see the "bottom" of the market is in the rearview mirror. That being said, if the market stays flat or prices rise slightly again this month, we just may have seen the bottom of this decline.

Active inventory sits at 6.64 months currently which is a balanced, normal market. Anything in the 4-6 months is considered a balanced market, and over 7 month of available inventory is considered a buyers market. (Months of inventory is calculated by taking the number of active listing and dividing by the number of sales in a given 30 day period)

The list to sale ratio for September 2022 was just under 40% at 38.65%, meaning that only 2 out of 5 homes on the market sold during a 30 day period. If you are looking to sell your home, this is an important number to keep in mind as you want to make sure your presentation and pricing is compelling enough to encourage buyers to make your home one of the 2 that sell.

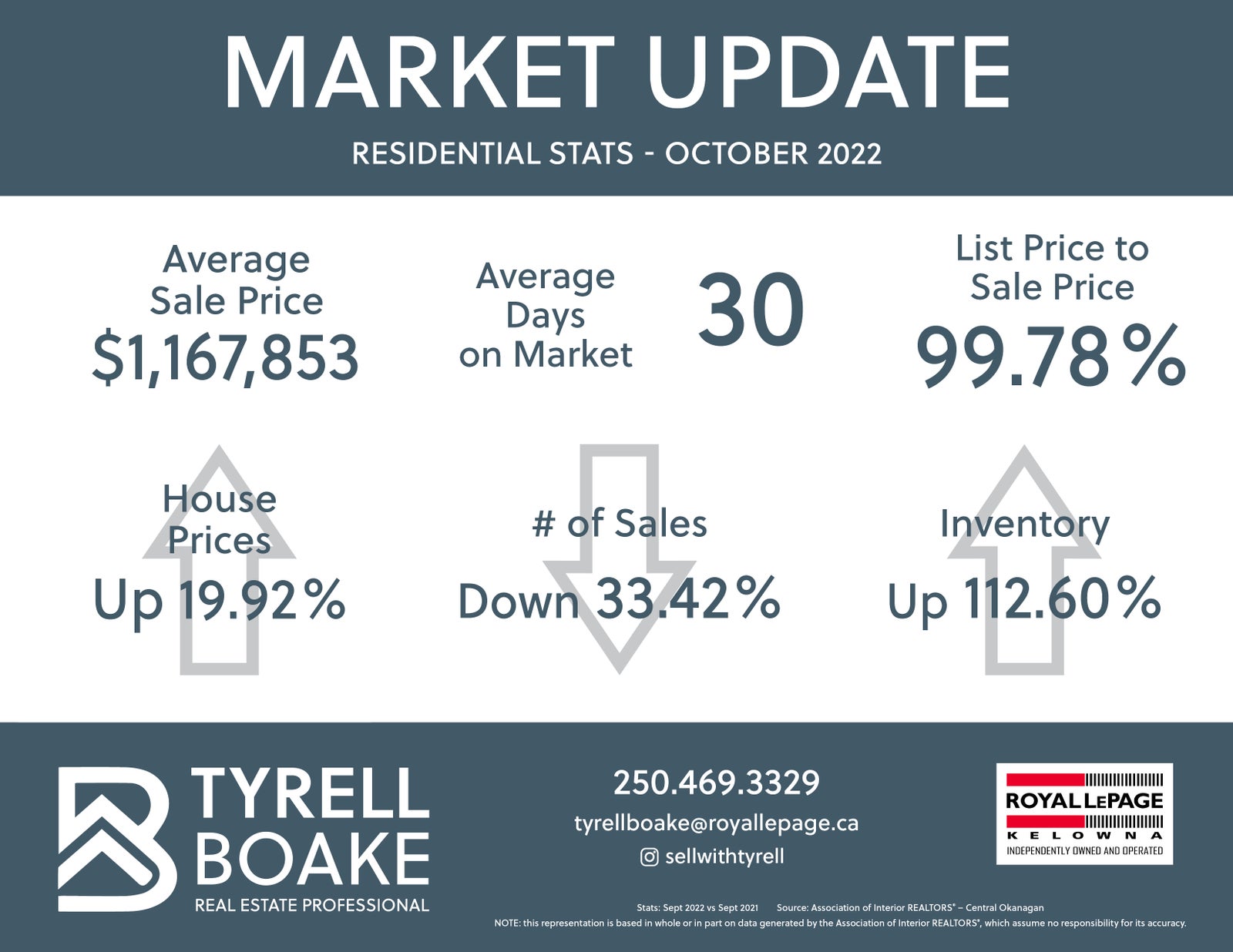

And if you are a buyer, and something sellers should keep in mind, is that the Price Ratio, or how much a home sells for relative to last asking price, is 95.54%. This means a buyer can expect to have an accepted offer of about 95% of asking price, or about $5000 below asking price for each $100,000. This is lower than the YTD figure of 99.78% which is a reflection of the spring market where we were still seeing an "auction" in many areas and homes were selling for above asking price.

Market activity is slower, with sales down from last year about 33% but, as I have said before, 2021 was an exceptionally busy year and going forward will look like an anomaly from normal markets. Homes are still selling every day and buyers are always looking for opportunities.

A key figure in all of this is that home prices are nearing what they were in January of this year, and are up slightly from last fall. And, they are still up about 40% from what they were 2 years ago. There was a spike in the spring but if you are in the market, you have still seen healthy growth in your investment.